"An Attorney near me" - Cape Town legal directory

lawyer@capetownlawyer.co.za or WhatsApp

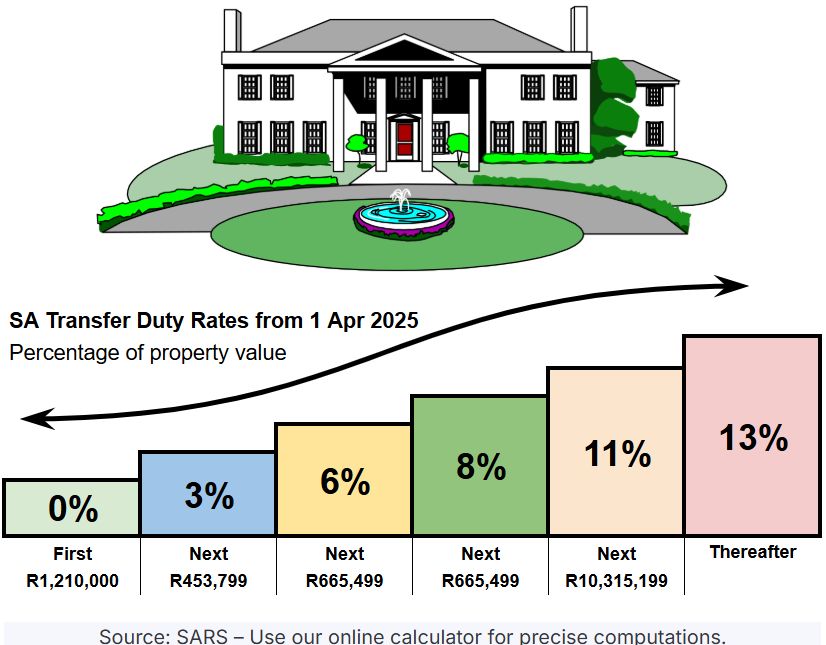

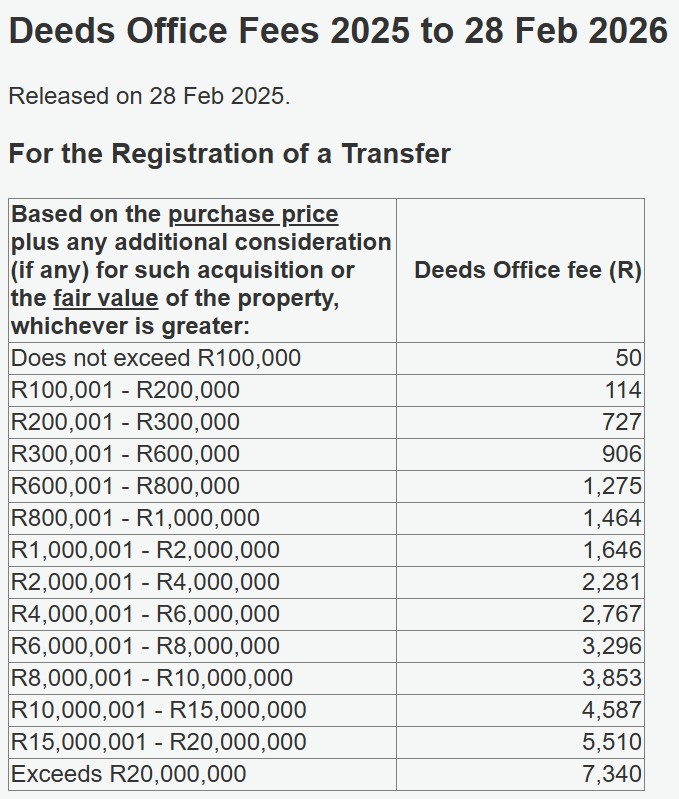

Enter the property value (usually equals consideration payable) into the calculator above, and transfer duty (as well as other transfer costs) will be calculated. The calculator currently uses transfer duty rates applicable from 1 April 2025 (new rates will be announced in 2026); it also factors in attorney transfer costs applicable from 1 Aug 2025.

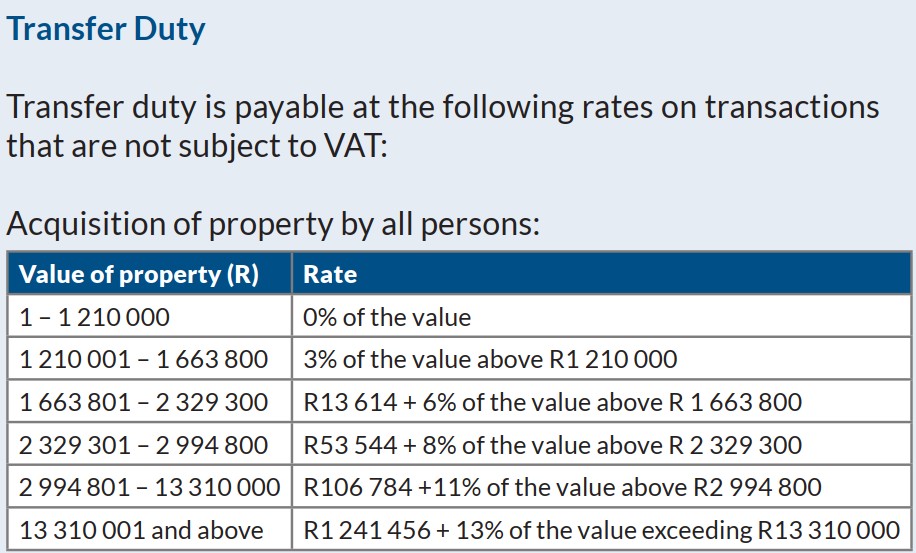

How to Calculate Transfer Duty

Transfer Duty is a tax on property purchases greater than R1,210,000 where the property is not VATable and not being inherited from a deceased estate, it is one of a variety of transactional costs incurred when properties are bought (the conveyancing fee paid to an attorney is another example of a property transfer cost). These transfer duty rates were confirmed by National Treasury on 12 March 2025, to be applicable on transactions from 1 April 2025.

- Value of the property is less than R1,210,000

- Transfer duty = R0 (no transfer duty)

- Value of the property is from R1,210,001 to R1,663,800

- Transfer duty = 3% of the value above R1,210,000

- Value of the property is from R1,663,800 to R2,329,300

- Transfer duty = R13,614 + 6% of the value above R1,663,800

- Value of the property is from R2,329,300 to R2,994,800

- Transfer duty = R53 544 + 8% of the value above R2,329,300

- Value of the property is from R2,994,800 to R13,310,000

- Transfer duty = R106,784 + 11% of the value above R2,994,800

- Value of the property is from R13,310,000 and above

- Transfer duty = R1,241,456 + 13% of the value exceeding R13,310,000

Transfer Duty Examples on 2025/2026 rates

The following examples illustrate how the 2026 rates apply to various property values, helping you estimate potential transfer duty costs.

Example 1: Property Purchased for R1,000,000

- Value: R1,000,000

- Applicable Rate: Up to R1,210,000 = R0

- Calculation: Since the value is below R1,210,000, no transfer duty is payable.

- Transfer Duty: R0

Example 2: Property Purchased for R1,500,000

- Value: R1,500,000

- Applicable Rate: 3% of the value above R1,210,000

- Calculation:

- R1,500,000 - R1,210,000 = R290,000

- 3% of R290,000 = 0.03 × R290,000 = R8,700

- Transfer Duty: R8,700

Example 3: Property Purchased for R2,000,000

- Value: R2,000,000

- Applicable Rate: R13,614 + 6% of the value above R1,663,800

- Calculation:

- R2,000,000 - R1,663,800 = R336,200

- 6% of R336,200 = 0.06 × R336,200 = R20,172

- R13,614 + R20,172 = R33,786

- Transfer Duty: R33,786

Example 4: Property Purchased for R2,500,000

- Value: R2,500,000

- Applicable Rate: R53,544 + 8% of the value above R2,329,300

- Calculation:

- R2,500,000 - R2,329,300 = R170,700

- 8% of R170,700 = 0.08 × R170,700 = R13,656

- R53,544 + R13,656 = R67,200

- Transfer Duty: R67,200

Example 5: Property Purchased for R5,000,000

- Value: R5,000,000

- Applicable Rate: R106,784 + 11% of the value above R2,994,800

- Calculation:

- R5,000,000 - R2,994,800 = R2,005,200

- 11% of R2,005,200 = 0.11 × R2,005,200 = R220,572

- R106,784 + R220,572 = R327,356

- Transfer Duty: R327,356

Example 6: Property Purchased for R15,000,000

- Value: R15,000,000

- Applicable Rate: R1,241,456 + 13% of the value exceeding R13,310,000

- Calculation:

- R15,000,000 - R13,310,000 = R1,690,000

- 13% of R1,690,000 = 0.13 × R1,690,000 = R219,700

- R1,241,456 + R219,700 = R1,461,156

- Transfer Duty: R1,461,156

Notes: These examples assume the property value equals the consideration payable and that no additional factors (e.g., fair value adjustments, VAT, or exemptions) apply. The 2026 rates adjust thresholds and base amounts upward from 2025, reducing the duty payable in some cases due to bracket creep relief. For comparison:

- R1,000,000: R0 (2025) vs. R0 (2026)

- R1,500,000: R12,000 (2025) vs. R8,700 (2026)

- R2,000,000: R41,625 (2025) vs. R33,786 (2026)

- R2,500,000: R79,275 (2025) vs. R67,200 (2026)

- R5,000,000: R347,600 (2025) vs. R327,356 (2026)

- R15,000,000: R1,505,600 (2025) vs. R1,461,156 (2026)

Who pays the transfer duty and by when?

In a property transaction the buyer pays the transfer duty; if a right to property is being renounced, the person who benefits from the renunciation pays the transfer duty. The transfer duty due is paid to the South African Government via the SA Revenue Service (SARS); it must be paid within 6 months of the property being acquired. Transfer duty must be paid to the SARS via eFiling; payment is normally effected by the conveyancing attorney involved.

Old transfer duty rates to 28 Feb 2025

The Transfer Duty Act of South Africa governs the process of paying transfer duty and the rates are set by the SARS; which provide an annual update (usually accompanying the budget speech) for the upcoming tax year for rates and brackets; the below is for the tax year from 1 Mar 2024 to 28 Feb 2025 (although there were no changes from the applicable transfer duty rates from 1 Mar 2023 to 29 Feb 2024; i.e. the Government has allowed some "bracket creep" to occur).

- Value of the property is less than R1,100,000

- Transfer duty = R0 (no transfer duty)

- Value of the property is from R1,100,001 to R1,512,500

- Transfer duty = 3% of the value above R1,100,000

- Value of the property is from R1,512,501 to R2,117,500

- Transfer duty = R12,375 + 6% of the value above R1,512,500

- Value of the property is from R2,117,501 to R2,722,500

- Transfer duty = R48,675 + 8% of the value above R2,117,500

- Value of the property is from R2,722,501 to R12,100,000

- Transfer duty = R97,075 + 11% of the value above R2,722,500

- Value of the property is from R12,100,001 and above

- Transfer duty = R1,128,600 + 13% of the value exceeding R12,100,000

VAT, Transfer Duty or Estate costs/duty?

One way, or another; somebody is likely to have to pay either VAT, transfer duty or incur estate fees/duty on property transfers.

- VAT: Payable on sales by VAT-registered vendors. No transfer duty. The VAT rate of 15% is higher than transfer duty rates which max out at 13%.

- Transfer Duty: Payable on sales by non-VAT vendors above the threshold.

- Estate Duty: Relevant for inherited properties. No transfer duty, but estate duty and executor fees may apply.

Is Property purchase subject to VAT?

The decision on whether VAT or transfer duty applies depends largely on whether the owner is registered for VAT (ie a VAT vendor). If the property is being sold by an owner which is a VAT vendor (like a property developer) as part of their business, then Value Added Tax (VAT) is already included in the purchase price, and transfer duty is not payable. If a property is not being sold by an owner registered for VAT, then transfer duty will be levied (see further details and complexities below).

Estate duty and other costs

Transfer duty is not payable on inherited property, so you may want to allow your heirs to inherit your property to avoid transfer duty. You need to also think about what executor fees your estate would pay (not a tax, if that makes a difference) and property valuation fees. Also, it's only the first R3.5m (at the time of writing) of the net value of an estate which is exempt from Estate Duty there's 20% estate duty charged on the first R30m above R3.5m and 25% on the value above that.

CGT, Donations Tax and Income Tax

Let's also not forget that property sales trigger Capital Gains Tax (a tax payable by the seller, unless below the threshold), donations tax may come into play and even sometimes income tax.

Value on which transfer duty is payable

The value of the property on which transfer duty is payable is usually equal to the consideration payable, except where fair value is higher; there are a lot of details to this, and these are set out mostly in section 5 of the Transfer Duty Act of 1949 (it does get complex, and if you have any uncertainties then do discuss it with your property lawyer):

For example a husband may wish to donate the house to his wife for free; whereas if the house were sold to an outside party it would fetch a much higher price, let's say R2m. In this case the fair value of R2m is much higher than the price for which the property was sold (R0).

-

The Transfer Duty Act outlines specific rules for calculating transfer duty in various situations. Here are some key examples.

- "(1) The value on which duty shall be payable shall, subject to the provisions of this section—

- (a) where consideration is payable by the person who has acquired the property, be the amount of that consideration; and

- (b) where no consideration is payable, be the declared value of the property."

-

"(2)

- (a) If a transaction whereby property has been acquired, is, before registration of the acquisition in a deeds registry, cancelled, or dissolved by the operation of a resolutive condition, duty shall be payable only on that part of the consideration which has been or is paid to and retained by the seller and on any consideration payable by the buyer for or in respect of the cancellation thereof, provided that on cancellation or dissolution of that transaction, such property completely reverts to the seller and the original buyer has relinquished all rights and has not received nor will receive any consideration arising from such cancellation or dissolution."

- "(b) Upon the subsequent disposal of property referred to in paragraph (a), the person so disposing of it shall, in the declaration to be made by him in terms of section 14, set forth the circumstances of such previous transaction and of the cancellation thereof and shall furnish particulars relating to the payment of duty in connection therewith, and any duty payable in connection with such previous transaction but still unpaid shall be paid by the person so disposing of the property, who may thereupon recover the duty so paid from the person liable for the payment thereof in terms of section 3."

- "(3) Where a transaction provides for the payment of the whole or any part of the consideration by way of rent, royalty, share of profits or any other periodical payment, or otherwise than in cash, the value of such consideration shall be determined in accordance with the provisions of section 8."

- "(4) In the case of a transaction whereby one property is exchanged for another, and— (a) no additional consideration is payable by either party to the transaction, the value on which duty shall be payable in respect of the acquisition of each property shall, subject to the provisions of subsections (6) and (7), be the declared value of each property: Provided that if the properties exchanged are not of equal value, duty shall, subject to the said provisions, be paid in respect of the acquisition of each property on the declared value of the property which has the greater value; (b) additional consideration is payable by either party to the transaction, the value on which duty shall be payable, shall, subject to the provisions of subsections (6) and (7), be— (i) in respect of the acquisition of the property for which the additional consideration is payable, the declared value of that property, or the declared value of the property given in exchange for that property plus the additional consideration payable, whichever is the greater; and (ii) in respect of the acquisition of the other property, the declared value thereof, or the declared value of the property given in exchange for that property less the additional consideration payable, whichever is the greater."

- "(5) In the case of the cession of a lease or sublease referred to in paragraph (c) of the definition of “property” in section 1, the value on which duty shall be payable shall be the amount of the consideration payable by the cessionary to the cedent in respect of the cession or, if no consideration is so payable, the declared value of the property acquired under the cession."

- "(6) f the Commissioner is of opinion that the consideration payable or the declared value is less than the fair value of the property in question he may determine the fair value of that property, and thereupon the duty payable in respect of the acquisition of that property shall be calculated in accordance with the fair value as so determined or the consideration payable or the declared value, whichever is the greatest: Provided that the provisions of this subsection shall not be construed as preventing the Commissioner, after a determination of the fair value of the property in question has been made, from revising such determination or from making a further determination of the fair value of that property under this subsection, provided such revision or further determination is made not later than two years from the date on which duty was originally paid in respect of the said acquisition."

-

"(7) In determining the fair value in terms of subsection (6), the Commissioner shall have regard, according to the circumstances of the case, inter alia to—

- (a) the nature of the real right in land and the period for which it has been acquired or, where it has been acquired for an indefinite period or for the natural life of any person, the period for which it is likely to be enjoyed;

- (b) the municipal valuation of the property concerned;

- (c) any sworn valuation of the property concerned furnished by or on behalf of the person liable to pay the duty;

- (d) any valuation made by the Director-General: Mineral Resources or by any other competent and disinterested person appointed by the Commissioner."

- "(8) If the fair value of property as determined by the Commissioner— (a) exceeds the amount of the consideration payable in respect of that property, or the declared value, as the case may be, by not less than one-third of the consideration payable or the declared value, as the case may be, the costs of any valuation made by a person referred to in paragraph (d) of subsection (7) (other than the Director-General: Mineral Resources) shall be paid by the person liable for the payment of the duty; (b) does not exceed the said consideration or declared value as the case may be, to the extent set out in paragraph (a), the costs of the valuation shall be borne by the State."

- "9) The provisions of subsections (6) and (7) shall not apply in respect of the acquisition of property sold by public auction, unless the Commissioner is satisfied that the sale was not a bona fide sale by public auction, or that there was collusion between the seller and the purchaser or their agents."

- "(10) In the case of the acquisition of property in terms of Item 8 of Schedule 1 to the Share Blocks Control Act, 1980 (Act 59 of 1980), the value of that property shall be reduced by an amount equal to the value of any supply made to the person acquiring that property, of a share mentioned in section 8(17) of the Value-Added Tax Act, 1991 (Act 89 of 1991), where— (i) tax in respect of such supply has been paid in terms of that Act; or (ii) such supply is in terms of that Act subject to tax at the rate of zero per cent, if the value of such share wholly or partly constitutes consideration for the acquisition of that property."

- (11) Where any person has acquired any property and any consideration has in terms of section 6(1)(c) been added to the consideration payable by such person in respect of such property, the value of that property shall be reduced by an amount equal to the value which constitutes consideration of any supply of such property made to the person acquiring that property, if in terms of the Value-Added Tax Act, 1991 (Act 89 of 1991)— (a) value-added tax in respect of such supply has been paid or will be accounted for; or (b) such supply is subject to value-added tax at the rate of zero per cent."

Transfer duty usually based on consideration payable

Impact of Cancellations on transfer duty

Where not all payment is upfront in cash

Where one property is exchanged for another

Cession of a lease or sublease

If consideration is less than fair value of property

How to determine fair value

Who pays costs of valuation?

Exceptions for public auctions

Exceptions for Share Blocks acquisitions

6(1)(c) payments

"[6(1)(c)any consideration which the person who has acquired property has paid or agreed to pay to any person whatsoever in respect of or in connection with the acquisition of the property, over and above the consideration payable to the person from whom the property was acquired, other than any rent payable under a lease or sublease by the cessionary thereof.]Note that the Act does change from time to time; so be sure to check whether the above is still accurate before making any decisions.

What is immovable property?

Immovable property includes townhousers, houses, farms and land; property owned by sectional title and shares in companies (or closed corporations) whose main asset is a property.

When must transfer duty be paid?

Transfer duty must be paid within six months from the date of acquisition to avoid interest charges.

When is no transfer duty payable?

- If your property costs less than R1 210 000, you will not be required to pay transfer duty (from 1 April 2025). This threshold is reviewed annually (it was R1 100 000 for the tax year to Feb 2025, and prior to that R1 000 000).

- If the seller is registered for VAT and selling as part of its business; and VAT has been included in the purchase price.

- The property is being inherited from a deceased estate (but if the deceased estate is sold for a cash consideration, transfer duty is payable).

- Property purchases by the SA Government may be exempt from paying transfer duty.

Resources

- Click here to see the SARS Transfer Duty Guide 6th edition.

- Click here to see SARS's Transfer Duty tables.

Payment process

Usually the transfer costs are paid by the Purchaser of the Property, and this would be stipulated in the Offer to Purchase. Once the transfer costs are paid accross to the conveyancing attorrneys, they will pay the Transfer Duty to the South African Revenue Service, who will acknowledge the payment by issuing a Transfer Duty Receipt.

Deceased Estate Property Transfer Duty

If phsyical property is being inherited from a deceased estate, then no transfer duty is payable; although other transfer costs are payable, and unlike in a normal transaction where the purchaser pays the transfer costs, the deceased estate is liable to pay the transfer costs on property being inherited from the estate.

However, if the estate sells the property for a cash amount, then transfer duty is payable on the cash sale; and it is payable by the purchaser of the property (not by the deceased estate).

Value added tax

When purchasing property either VAT or transfer duty is paid, but not both. Transfer duty applies instead of VAT under either of these conditions: (1) the property seller is not registered for VAT, or (2) although the seller is a VAT-registered vendor, the property does not constitute part of the seller's business activities.

History of Transfer Duty in SA

- 1910 At the Union of South Africa, transfer duty was fixed at 2% (everywhere other than the Transvaal).

Property transfer & sale Info

Sellers of property & buyers, speak to a property lawyer before you hire an estate agent!

- The property transfer process in South Africa - protect your interests.

- Conveyancing lawyers in Cape Town.

- Transfer costs calculator for property anywhere in South Africa.

- Can I negotiate transfer costs?

- Transfer attorney fees

- Fixed fee conveyancing in South Africa. Possible?

- Understanding the various conveyancing costs.

- Conveyancing quote

- New conveyancing fees from 27 May 2024

- Deeds office fees 29 Feb 2024.

- Law Society conveyancing fees 2023

- Law Society conveyancing fees 2024

- Conveyancing fees 2025

- Conveyancing fees 2026

- Bond attorney fees

- Transfer Duty calculator

- Deceased estate property transfer costs

- Deeds Registeries Act.

- Servitudes

- Usufruct Agreement on Property in South African law.

- Usufruct value calculator (only one in South Africa)

- Usufruct Agreement on Property in South African law.

- Land conveyancing

- Transfer attorney vs bond attorney.

- Commercial Property:

- Marriage/Divorce-related:

- How to transfer property from husband to wife (or vice versa); whilst still married (ie not getting divorced).

- "Protection" of fixed property using a trust.

- Conveyancers conduct the transfer of property ownership from one spouse to another (or to a third party, if relevant).

- Liquidator to sell property & divide proceeds as part of divorce.

- Property sales

- Use conveyancer to guide your private property sale.

- Instead of using real estate agents rather use professional lawyers to sell your property.

- Urgent house sale.

- How to check whether an estate agent is licensed.

- Example of a property sales agreement.

- FLISP Housing subsidies.

- Property practitioner's Act.

- Code to guide conduct of property practitioners.

- Property purchases

- Scams property purchasers should watch out for.

- Home loan repayments calculator, with an estimate of the adjustment to prime to reflect the borrower's credit risk profile.

- Terminology

- Arranging lodgement

- Compliance certificates

- Conveyancer's certificate

- Deed of Sale

- Deeds officer examiner

- Existing bonds

- FICA documents

- Levy clearance certificate

- Offer to purchase

- Property sale agreement

- Property search

- Rates clearance certificate

- Statement of account

- Suspensive condition

- Title deed

- Transfer documents

Conveyancing & property transfer discussion forum

Note that this is a public forum - exercise caution before acting on info and use at own risk. Anybody may ask and answer, and you don't know what their level of expertise is. No information on this website should be acted on without first consulting with a lawyer to test its validity. Do not share private details here.